nebraska auto sales tax

There are no changes to local sales and use tax rates that are effective January 1 2022. If you are registering a motorboat contact the Nebraska Game and Parks Commission.

All About Bills Of Sale In Nebraska The Forms And Facts You Need

Bringing a car into America from another country can be a tricky process.

. 31 rows The state sales tax rate in Nebraska is 5500. The sales tax rate is calculated at the rate in effect at that location. Nebraska vehicle title and registration resources.

Deliveries into another state are not subject to Nebraska sales tax. The Nebraska state sales and use tax rate is 55 055. In Nebraska the sales tax percentage is 55 meaning that you pay 55 of your vehicles value in addition to the total value of the car.

Here are five additional taxes and fees that go along with a vehicle purchase. Sarpy County Courthouse Campus 1210 Golden Gate Drive Papillion NE 68046 402-593-2100 Sarpy County 1102 Building 1102 E. You can find these fees further down on the page.

Nebraska Sales Tax on Cars. Purchase of a 30-day plate by a nonresident of Nebraska who does not intend. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0825 on top of the state tax.

Deliveries into a Nebraska city that imposes a local sales tax are taxed at the state rate 55 plus the applicable local rate. A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Nebraska local counties cities and special taxation districts.

The point of delivery determines the location of the sale. In addition to our brief summary you should study Vehicle Importation Regulations and then contact an expert to help you at the National Highway Traffic Safety Administration NHTSA at 888 327-4236. There are no changes to local sales and use tax rates that are effective July 1 2022.

How Does Sales Tax Apply to Vehicle Sales. Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards Form 65 Sales and Use Tax Rate Cards Form 7 Sales and Use Tax Rate Cards Form 725 Sales and Use Tax Rate Cards Form 75 Sales and Use Tax Rate Cards Form Nebraska Application for Direct. 150 - State Recreation Road Fund - this fee.

Browse through a selection of forms and documents provided by the Treasurers office and the State of Nebraska. Questions regarding Vehicle Registration may be addressed by email or by phone at 402 471-3918. Request for Taxes Fees Paid.

Vehicles are considered by the IRS as a good that can be purchased sold and traded. Like all other goods retailers are required to charge a sales tax on the sales of all vehicles. Money from this sales tax goes towards a whole host of state-funded projects and programs.

Nebraska has recent rate changes Thu Jul 01 2021. The state of NE like most other states has a sales tax on car purchases. Learn more about how to renew your vehicle registration and license plates.

Current Local Sales and Use Tax Rates Vehicles Towed from Private PropertyVehicles Left Unattended on Private Property Transfer of Ownership. The Nebraska sales tax on cars is 5. 200 - Department of Motor Vehicles Cash Fund - this fee stays with DMV.

With local taxes the total sales tax rate is between 5500 and 8000. Request to see Taxes and Fees paid on your Motor Vehicle from the Lancaster County Treasurers. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees.

This is because the first bracket is fairly wide 0 - 3999 and has only a 25 tax when new. Subsequent brackets increase the tax 10 to 40 for each 2000 of value when new or two percent. Select the Nebraska city from the list of popular cities.

This is less than 1 of the value of the motor vehicle. Sales and Use Tax Regulation 1-02202 through 1-02204. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax Collections Non-motor vehicle sales tax collections are compiled from county and city information that is selfreported by applicants when requesting a sales tax permit. The process is much easierand quickerif the vehicle. To remain in Nebraska more than 30 days from the date of purchase.

To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services. Additional fees collected and their distribution for every motor vehicle registration issued are. 1st Street Papillion NE 68046.

This means that depending on your location within Nebraska the total tax you pay can be significantly higher than the 55 state sales tax. Vehicle Title Registration. Failure to do so is a Class IV felony.

Register the vehicle and pay sales tax. 50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human Services. A vehicle that is recorded on the Purchasers Agreement which in turn is used to complete the Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6 as a trade-in must be titled in the name of the purchaser.

Qualified businessprofessional use to view vehicle. Nebraska SalesUse Tax and Tire Fee Statement. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles.

Registration Plates Renewal. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15.

Car Sales Tax In Nebraska Getjerry Com

Shop Furniture Appliances Electronics Flooring Home Decor Nebraska Furniture Mart Luxury Bedding Collections Furniture Shop Nebraska Furniture Mart

Old Illinois License Plate Tag White Blue Mk3845 Auto Garage Etsy License Plate Vintage License Plates Garage Decor

How Mhe Impacts Speed Of Fulfillment Nebraska Warehouse Material Handling Equipment Material Handling Fulfillment

Car Sales Tax In Nebraska Getjerry Com

![]()

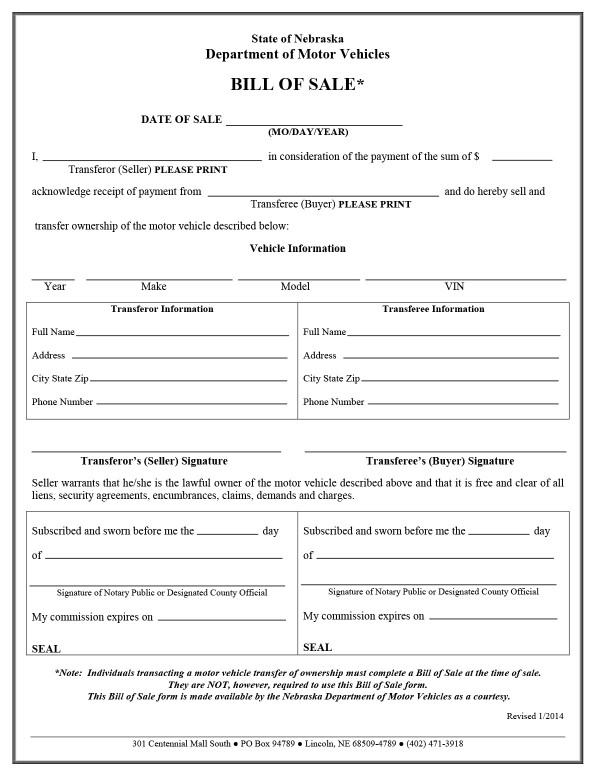

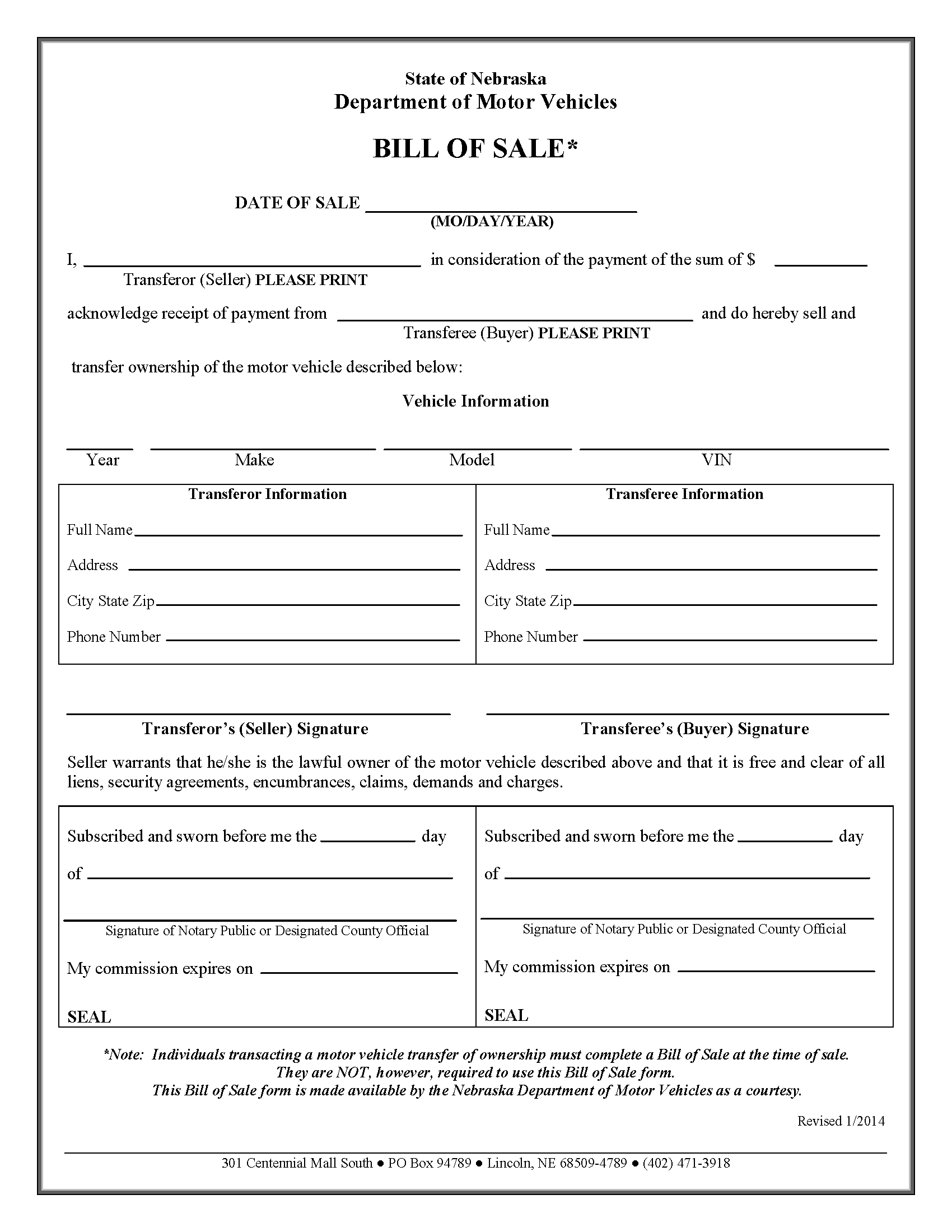

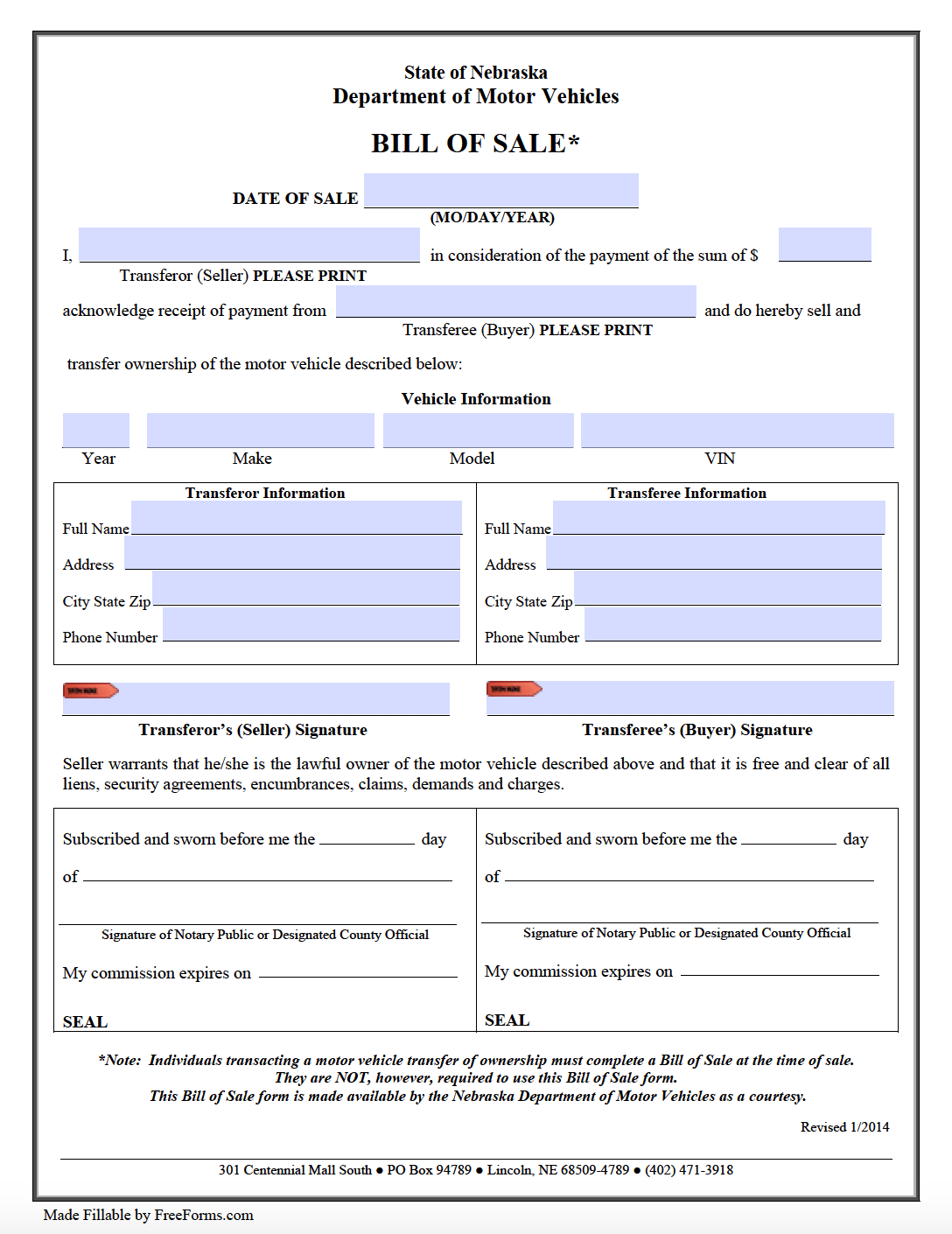

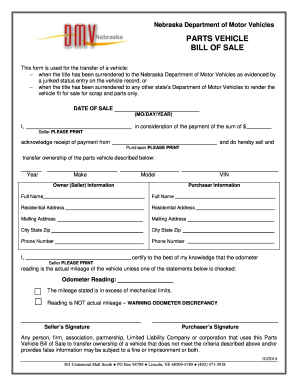

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

Virginia Considers Tolls Or Taxes To Pay For I 81 Upgrades Wtop News Rijden Auto Zangers

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Free Nebraska Motor Vehicle Bill Of Sale Form Pdf Word

Ford Autocar Motor Car Advert 1936 Ford Model Y

Vehicle And Boat Registration Renewal Nebraska Dmv

Free Nebraska Motor Vehicle Dmv Bill Of Sale Form Pdf

Taxes And Spending In Nebraska

Car Sales Tax In Nebraska Getjerry Com

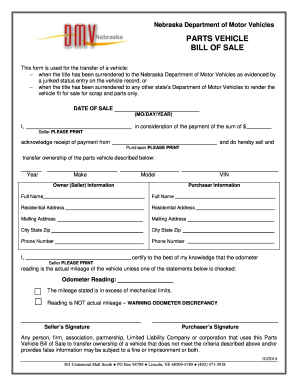

2014 2022 Form Ne Parts Vehicle Bill Of Sale Fill Online Printable Fillable Blank Pdffiller

Vehicle And Boat Registration Renewal Nebraska Dmv

2020 Ford Escape Plug In Hybrid Guarantees 37 Miles Per Cost 100 Mpge Ford Escape Ford Hybrid Car

Sales Tax On Cars And Vehicles In Nebraska

1961 Corner Windows North Bend Ne Pickup Trucks For Sale Truck Flatbeds Trucks For Sale